Virus’ mega million spree

Rough estimations indicate that the treatment of Covid-19 in the second and third waves on average cost private patients, private medical aid funds or the taxpayer a total of at least N$2 million per day.

Jo-Maré Duddy

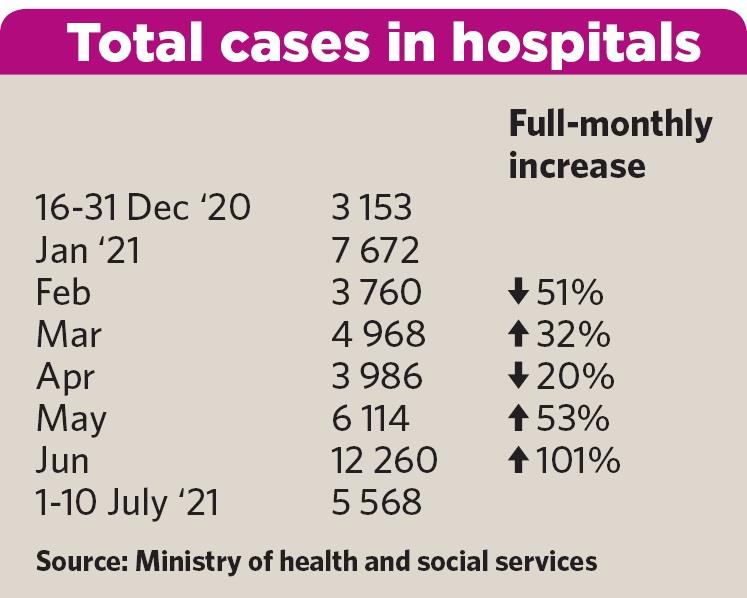

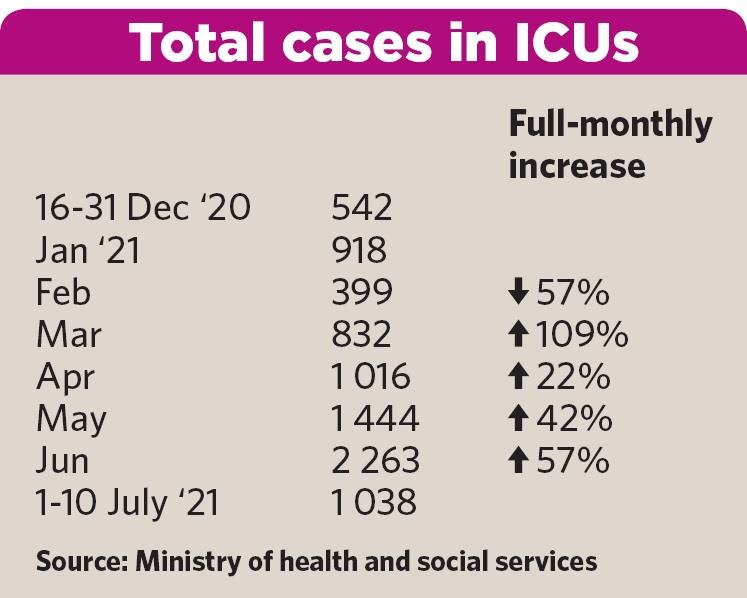

Basic hospitalisation, ICU occupancy and medicine for those who are fighting Covid-19 at home have so far cost at least half a billion Namibian dollars since the second and third waves of the coronavirus hit the country.The ministry of health and social services started breaking down hospitalisation and ICU occupancy due to Covid-19 from 16 December 2020. According to the ministry’s daily Covid-19 reports, patients spend a total 47 481 days in hospitals from 16 December 2020 to 10 July 2021. Days spent in intensive care units (ICUs) during the period totalled 8 320. “Days” for the purpose of this article refers to the combined time all patients spent in these facilities and not individual cases.

Information obtained anonymously by Business7 shows a day in a private hospital costs between N$4 500 and N$5 000 per person on average. This excludes the costs of specialists or special needs of Covid-19 patients, which vary from case to case. The more than 47 000 days spent in hospitals during the second and third waves therefore amount to a rough estimation of between N$214 million and N$237 million in total.

Being admitted to an ICU facility costs between N$15 000 and N$25 000 per person per day, excluding specialist and other additional, but necessary medical care. The 8 000-plus days spent in ICU in the past seven months thus totals between N$127 million and N$211 million, conservatively estimated.

COCKTAIL

The ministry reported a total of 89 603 new Covid-19 positive cases during the period under review. The standard cocktail of medicine prescribed by doctors to sick Covid-19 patients who treat themselves at home, costs between N$800 and N$1 200 per person per prescription.

Assuming half of these cases fight the virus at home – the other half either being in hospitals and ICUs or being asymptomatic or mildly affected – the total cost of the cocktail prescriptions could vary between N$36 million or N$54 million during the past seven months. This amount doesn’t include vitamins or other supplements and medications patients self-medicate with.

Roughly estimated, ‘basic’ hospitalisation, ICUs and home treatment cost Namibia between N$377 million and N$502 million in total so far for the 207 reported days marking the second and third waves. That roughly equates to an average of between N$1.8 million and N$2.4 million per day – costs that had to carried by private patients, private medical aid funds and the taxpayer through government’s medical aid scheme (Psemas) and treatment of state patients.

‘COSTS MASKED’

On page 4 of this publication, Business7 analyses the financial health of the private medical aid fund industry from 2015 to 2020, based on the latest available data by the Namibia Financial Institutions Supervisory Authority (Namfisa).

We also contacted major players in the industry to comment on the impact of Covid-19 on their business and received feedback from the Namibian Association of Medical Aid Funds (Namaf), Namibia Medical Care (NMC) and Renaissance Health Medical Aid Fund Namibia. Despite an undertaking from the ministry of finance to comment on the pandemic’s effect on Psemas, no response was received before deadline.

Namfisa’s data shows the impact of the first wave of Covid-19 on the medical aid fund industry was minimal. The industry as a whole reported a net surplus of around N$370 million for 2020, according to Namfisa latest quarterly report. In 2019, the figure was about N$136 million.

The results must be viewed in context, though. Namaf’s corporate affairs specialist, Uatavi Mbai, attributed the increase in the industry’s net surplus to the postponement of elective surgery and non-surgical routine care last year due to shortages of hospital beds and associated resources.

“The cost of Covid was offset by these postponements and consequently the cost of Covid was masked,” Mbai said.

NO BUSINESS AS USUAL

Because hospitals did not have the bed capacity to support normal theatre case volumes for elective and other non-emergency procedures, short-term health care expenditure was reduced or pushed out, the principal officer of Renaissance, Esther Mcleod, said.

Alison Begley, the principal officer of NMC, agreed. She added that the restriction of movement during lockdown also resulted in lower medical consultations to various medical service providers.

Namfisa data shows the industry settled hospital claims of about N$1.27 billion last year – a drop of some N$100 million or 7.3% compared to 2019.

Mcleod said hospital claims are the primary driver of healthcare expenditure and therefore the overall claims cost for medical aid funds reduced during 2020 despite an increase in medicine expenditure.

“The initial spike in March 2020 was due to individuals stocking up on immune boosters, as well as cough and cold medication in anticipation of the lockdown,” she said.

First quarter stats from Namfisa show the industry paid out nearly N$174.3 million in pharmacy claims last year, nearly N$33.8 million or 24% more than the same three months in 2019. Growth in claims for the other three quarters remained muted. Pharmacy claims for 2020 totalled nearly N$643.5 million, up some N$46 million or 7.7% from 2019.

SECOND WAVE

Namibia’a second Covid-19 wave peaked around the middle of December 2020 to the middle of January 2021.

From 16 December to the end of January, the health ministry reported a combined 10 825 days in hospital and 1 460 days in ICUs. Using the figures mentioned in the beginning of the article, the hospital and ICU costs related to this are roughly between N$70 million and N$90 million in total, excluding specialist care.

Both Renaissance and NMC reported higher claims during this period.

“December is generally a lower claiming month for medical aid funds due to holidays, but NMC’s claims for December 2020 were much higher than expected. High increases were mainly observed on hospital costs, general practitioners [GPs], specialists and acute medications,” according to Begley.

Namfisa data on total medical claims incurred during the second wave has not been made public yet.

THIRD WAVE

Following the peak of the second wave, Covid-19 positive cases started picking up sharply again in May when a combined 6 114 days in hospitals and 1 444 days in ICUs were recorded. In June, these numbers increased to 12 260 and 2 263 respectively. In the first ten days of July, 5 568 days in hospitals and 1 038 in ICUs were recorded.

Hospitals and ICUs overflowing with Covid-19 cases are again at the expense of hospital admissions for elective and other non-emergency procedures.

“Sadly, the fact that hospitals are filled beyond capacity has unfortunately resulted in patients who actually require hospital treatment, being treated at home as it was not possible to admit them into hospital. This is obviously an undesirable situation, but an unfortunate reality of the pandemic that we are facing,” said Mcleod.

She added: “Once the situation normalises the surgical and other medical cases that have been postponed are expected to result in an increase in claims.”

Commenting on the impact of the third wave on NMC, Begley said the fund’s initial projection for 2021 was that the claims would be higher, mainly because the cost of some of the medical procedures that did not take place in 2020 would be incurred during 2021, and also due to additional Covid-19 related expense for the current year.

“The third wave, however, came with significantly higher hospitalisation and fatality rates than expected, and hence resulted in higher claims. The claims incurred on NMC until May 2021 were slightly higher than expected and around 20% higher than the same period last year, with higher increases observed in hospital costs, GPs, specialists and pathology,” she said.

IMPACT

Namfisa data on total medical claims incurred during the current wave has not been made public yet.

Approached for comment, Namaf’s Mbai said: “We are not 100% sure yet, because the data must still be analysed more fully. But we are expecting that the financial impact on the funds will have been greater due to higher Covid-related hospitalisation and complication rates.”

According to McLeod, it is too soon to predict what the impact would be on medicine claims in the 2021 benefit year.

“It would depend on the overall infection rate for the remainder of the year. It is however anticipated that hospital claims will increase significantly the moment the third wave start to subside, as healthcare facilities and providers will start to catch up on the elective and non-emergency procedures that was postponed previously,” she said.

There remains significant uncertainty about the degree at which Covid-19 will impact various sectors, Begley stated.

“The perceptions will continue evolving with latest developments on the virus and the infection trends. The immediate impact of third wave (or any other waves) is higher medical costs to the funds which will is expected to reduce the reserve level of the funds,” she added.

RESERVES

At the end of last year, private medical aid funds had accumulated reserves of about N$1.9 billion in total, about 19% more than the end of 2019.

Medical aid funds are required to maintain a minimum prudential reserves level or solvency margin of 25% of gross contributions. The industry’s reserves level increased by 4.4% to 43.5% which exceeds the limit of 25% by almost double as at 31 December 2020, Namfisa said in its latest quarterly report.

The regulator pointed out that the industry remained well capitalised as it held a high percentage of free assets at the end of 2020, adding that it was deemed financially sound.

Begley agreed that industry as a whole has relatively strong reserves to absorb the increased costs and said it should remain financially sound post-Covid.

“The economic impact of Covid-19 (especially retrenchments, salary reductions, less employment and investment opportunities, etc) affects the growth of membership for the medical industry, which is important in ensuring the long-term sustainability of the industry,” she added.

To date the impact of Covid-19 on the industry has been “surprisingly minimal”, Mcleod said.

However, she added: “It is assumed that medical aid cover during a pandemic is put at the forefront by employers to assist their employees during such a difficult time. The question remains how long businesses, especially the tourism sector, can continue to employ staff and provide benefits.”

According to Namaf, the industry has good reserves which are designed to mitigate the abnormal circumstances such as the one that Namibia finds itself in at present.

“However, the situation might change if (1) member losses accelerate, (2) the duration of the pandemic extends and (3) the delays in the provision of elective surgery and other routine care cause a larger than expected catch-up effect in later years,” Mbai added.

Pres Hage Geingob in his Covid address at the end of last month said the peak of the third wave was only expected in the middle of August to September.

VACCINATE

According to the World Health Organisation (WHO) and other international literature, “the world must vaccinate itself out of this pandemic”, Mbai said.

The health ministry recently had to limited vaccinations to only people who receive their first dose of Sinopharm or AstraZeneca due to a supply shortage. Second doses are only administered in special cases.

Government wants to vaccinate 1 503 684 or 60% of the population by January. By 11 July, only 30 529 people or around 2% of the population were fully vaccinated.

“The public and private sector should work together to ensure a continuous supply of vaccines. To this end the private and public sectors have already made good progress to establish well-functioning vaccination sites together. However, the continuous supply of vaccines remains a concern,” McLeod said.

She continued: “Although there is still a lot that we need to learn regarding Covid-19 and the effectiveness of vaccines on the various variants, the data that is coming out seems to indicate that vaccination does reduce hospitalisation and death rates in the majority of cases.

“Therefore it is our view that the only viable long-term solution remains the rollout of robust vaccination programmes to ensure the majority of the population are vaccinated as soon as possible.”

Begley echoes Mcleod’s opinion.

“Research has proven that the Covid-19 vaccines significantly reduce the probability of severe illness and fatalities. Whilst saving lives is very crucial in the fight against Covid-19, a reduction in hospital cases reduces the medical expenses paid by the industry and hence strengthen the sustainability,” she said.

Basic hospitalisation, ICU occupancy and medicine for those who are fighting Covid-19 at home have so far cost at least half a billion Namibian dollars since the second and third waves of the coronavirus hit the country.The ministry of health and social services started breaking down hospitalisation and ICU occupancy due to Covid-19 from 16 December 2020. According to the ministry’s daily Covid-19 reports, patients spend a total 47 481 days in hospitals from 16 December 2020 to 10 July 2021. Days spent in intensive care units (ICUs) during the period totalled 8 320. “Days” for the purpose of this article refers to the combined time all patients spent in these facilities and not individual cases.

Information obtained anonymously by Business7 shows a day in a private hospital costs between N$4 500 and N$5 000 per person on average. This excludes the costs of specialists or special needs of Covid-19 patients, which vary from case to case. The more than 47 000 days spent in hospitals during the second and third waves therefore amount to a rough estimation of between N$214 million and N$237 million in total.

Being admitted to an ICU facility costs between N$15 000 and N$25 000 per person per day, excluding specialist and other additional, but necessary medical care. The 8 000-plus days spent in ICU in the past seven months thus totals between N$127 million and N$211 million, conservatively estimated.

COCKTAIL

The ministry reported a total of 89 603 new Covid-19 positive cases during the period under review. The standard cocktail of medicine prescribed by doctors to sick Covid-19 patients who treat themselves at home, costs between N$800 and N$1 200 per person per prescription.

Assuming half of these cases fight the virus at home – the other half either being in hospitals and ICUs or being asymptomatic or mildly affected – the total cost of the cocktail prescriptions could vary between N$36 million or N$54 million during the past seven months. This amount doesn’t include vitamins or other supplements and medications patients self-medicate with.

Roughly estimated, ‘basic’ hospitalisation, ICUs and home treatment cost Namibia between N$377 million and N$502 million in total so far for the 207 reported days marking the second and third waves. That roughly equates to an average of between N$1.8 million and N$2.4 million per day – costs that had to carried by private patients, private medical aid funds and the taxpayer through government’s medical aid scheme (Psemas) and treatment of state patients.

‘COSTS MASKED’

On page 4 of this publication, Business7 analyses the financial health of the private medical aid fund industry from 2015 to 2020, based on the latest available data by the Namibia Financial Institutions Supervisory Authority (Namfisa).

We also contacted major players in the industry to comment on the impact of Covid-19 on their business and received feedback from the Namibian Association of Medical Aid Funds (Namaf), Namibia Medical Care (NMC) and Renaissance Health Medical Aid Fund Namibia. Despite an undertaking from the ministry of finance to comment on the pandemic’s effect on Psemas, no response was received before deadline.

Namfisa’s data shows the impact of the first wave of Covid-19 on the medical aid fund industry was minimal. The industry as a whole reported a net surplus of around N$370 million for 2020, according to Namfisa latest quarterly report. In 2019, the figure was about N$136 million.

The results must be viewed in context, though. Namaf’s corporate affairs specialist, Uatavi Mbai, attributed the increase in the industry’s net surplus to the postponement of elective surgery and non-surgical routine care last year due to shortages of hospital beds and associated resources.

“The cost of Covid was offset by these postponements and consequently the cost of Covid was masked,” Mbai said.

NO BUSINESS AS USUAL

Because hospitals did not have the bed capacity to support normal theatre case volumes for elective and other non-emergency procedures, short-term health care expenditure was reduced or pushed out, the principal officer of Renaissance, Esther Mcleod, said.

Alison Begley, the principal officer of NMC, agreed. She added that the restriction of movement during lockdown also resulted in lower medical consultations to various medical service providers.

Namfisa data shows the industry settled hospital claims of about N$1.27 billion last year – a drop of some N$100 million or 7.3% compared to 2019.

Mcleod said hospital claims are the primary driver of healthcare expenditure and therefore the overall claims cost for medical aid funds reduced during 2020 despite an increase in medicine expenditure.

“The initial spike in March 2020 was due to individuals stocking up on immune boosters, as well as cough and cold medication in anticipation of the lockdown,” she said.

First quarter stats from Namfisa show the industry paid out nearly N$174.3 million in pharmacy claims last year, nearly N$33.8 million or 24% more than the same three months in 2019. Growth in claims for the other three quarters remained muted. Pharmacy claims for 2020 totalled nearly N$643.5 million, up some N$46 million or 7.7% from 2019.

SECOND WAVE

Namibia’a second Covid-19 wave peaked around the middle of December 2020 to the middle of January 2021.

From 16 December to the end of January, the health ministry reported a combined 10 825 days in hospital and 1 460 days in ICUs. Using the figures mentioned in the beginning of the article, the hospital and ICU costs related to this are roughly between N$70 million and N$90 million in total, excluding specialist care.

Both Renaissance and NMC reported higher claims during this period.

“December is generally a lower claiming month for medical aid funds due to holidays, but NMC’s claims for December 2020 were much higher than expected. High increases were mainly observed on hospital costs, general practitioners [GPs], specialists and acute medications,” according to Begley.

Namfisa data on total medical claims incurred during the second wave has not been made public yet.

THIRD WAVE

Following the peak of the second wave, Covid-19 positive cases started picking up sharply again in May when a combined 6 114 days in hospitals and 1 444 days in ICUs were recorded. In June, these numbers increased to 12 260 and 2 263 respectively. In the first ten days of July, 5 568 days in hospitals and 1 038 in ICUs were recorded.

Hospitals and ICUs overflowing with Covid-19 cases are again at the expense of hospital admissions for elective and other non-emergency procedures.

“Sadly, the fact that hospitals are filled beyond capacity has unfortunately resulted in patients who actually require hospital treatment, being treated at home as it was not possible to admit them into hospital. This is obviously an undesirable situation, but an unfortunate reality of the pandemic that we are facing,” said Mcleod.

She added: “Once the situation normalises the surgical and other medical cases that have been postponed are expected to result in an increase in claims.”

Commenting on the impact of the third wave on NMC, Begley said the fund’s initial projection for 2021 was that the claims would be higher, mainly because the cost of some of the medical procedures that did not take place in 2020 would be incurred during 2021, and also due to additional Covid-19 related expense for the current year.

“The third wave, however, came with significantly higher hospitalisation and fatality rates than expected, and hence resulted in higher claims. The claims incurred on NMC until May 2021 were slightly higher than expected and around 20% higher than the same period last year, with higher increases observed in hospital costs, GPs, specialists and pathology,” she said.

IMPACT

Namfisa data on total medical claims incurred during the current wave has not been made public yet.

Approached for comment, Namaf’s Mbai said: “We are not 100% sure yet, because the data must still be analysed more fully. But we are expecting that the financial impact on the funds will have been greater due to higher Covid-related hospitalisation and complication rates.”

According to McLeod, it is too soon to predict what the impact would be on medicine claims in the 2021 benefit year.

“It would depend on the overall infection rate for the remainder of the year. It is however anticipated that hospital claims will increase significantly the moment the third wave start to subside, as healthcare facilities and providers will start to catch up on the elective and non-emergency procedures that was postponed previously,” she said.

There remains significant uncertainty about the degree at which Covid-19 will impact various sectors, Begley stated.

“The perceptions will continue evolving with latest developments on the virus and the infection trends. The immediate impact of third wave (or any other waves) is higher medical costs to the funds which will is expected to reduce the reserve level of the funds,” she added.

RESERVES

At the end of last year, private medical aid funds had accumulated reserves of about N$1.9 billion in total, about 19% more than the end of 2019.

Medical aid funds are required to maintain a minimum prudential reserves level or solvency margin of 25% of gross contributions. The industry’s reserves level increased by 4.4% to 43.5% which exceeds the limit of 25% by almost double as at 31 December 2020, Namfisa said in its latest quarterly report.

The regulator pointed out that the industry remained well capitalised as it held a high percentage of free assets at the end of 2020, adding that it was deemed financially sound.

Begley agreed that industry as a whole has relatively strong reserves to absorb the increased costs and said it should remain financially sound post-Covid.

“The economic impact of Covid-19 (especially retrenchments, salary reductions, less employment and investment opportunities, etc) affects the growth of membership for the medical industry, which is important in ensuring the long-term sustainability of the industry,” she added.

To date the impact of Covid-19 on the industry has been “surprisingly minimal”, Mcleod said.

However, she added: “It is assumed that medical aid cover during a pandemic is put at the forefront by employers to assist their employees during such a difficult time. The question remains how long businesses, especially the tourism sector, can continue to employ staff and provide benefits.”

According to Namaf, the industry has good reserves which are designed to mitigate the abnormal circumstances such as the one that Namibia finds itself in at present.

“However, the situation might change if (1) member losses accelerate, (2) the duration of the pandemic extends and (3) the delays in the provision of elective surgery and other routine care cause a larger than expected catch-up effect in later years,” Mbai added.

Pres Hage Geingob in his Covid address at the end of last month said the peak of the third wave was only expected in the middle of August to September.

VACCINATE

According to the World Health Organisation (WHO) and other international literature, “the world must vaccinate itself out of this pandemic”, Mbai said.

The health ministry recently had to limited vaccinations to only people who receive their first dose of Sinopharm or AstraZeneca due to a supply shortage. Second doses are only administered in special cases.

Government wants to vaccinate 1 503 684 or 60% of the population by January. By 11 July, only 30 529 people or around 2% of the population were fully vaccinated.

“The public and private sector should work together to ensure a continuous supply of vaccines. To this end the private and public sectors have already made good progress to establish well-functioning vaccination sites together. However, the continuous supply of vaccines remains a concern,” McLeod said.

She continued: “Although there is still a lot that we need to learn regarding Covid-19 and the effectiveness of vaccines on the various variants, the data that is coming out seems to indicate that vaccination does reduce hospitalisation and death rates in the majority of cases.

“Therefore it is our view that the only viable long-term solution remains the rollout of robust vaccination programmes to ensure the majority of the population are vaccinated as soon as possible.”

Begley echoes Mcleod’s opinion.

“Research has proven that the Covid-19 vaccines significantly reduce the probability of severe illness and fatalities. Whilst saving lives is very crucial in the fight against Covid-19, a reduction in hospital cases reduces the medical expenses paid by the industry and hence strengthen the sustainability,” she said.

Comments

Namibian Sun

No comments have been left on this article