Govt debt rises to N$117bn

Financing of the 2020/21 national budget, which has ballooned to fight the impacts of the coronavirus, will see government debt stock rising to a record high.

OGONE TLHAGE

WINDHOEK

Finance minister Ipumbu Shiimi has tabled a N$64.3 billion budget, with a whopping extra N$8.4 billion, or 16.4% of revenue, earmarked for the payment of interest on government loans.

Therefore, total expenditure, including interest payments for the 2020/21 financial year, amounts to N$72.8 billion.

The medium-term expenditure framework (MTEF) released last year had estimated a N$60.4 billion budget this year, but that was before the coronavirus pandemic hit.

The budget deficit will be financed through a combination of savings and domestic and external borrowing.

“Taking into account the total financing requirements, the debt stock is estimated to rise to N$117.5 billion, corresponding to 68.7% of GDP, from 54.8% estimated for 2019/20.”

Shiimi described his 2020/21 offering as single-year budget, reflecting the commensurate urgency of addressing the elevated once-off needs arising from the impact of the pandemic.

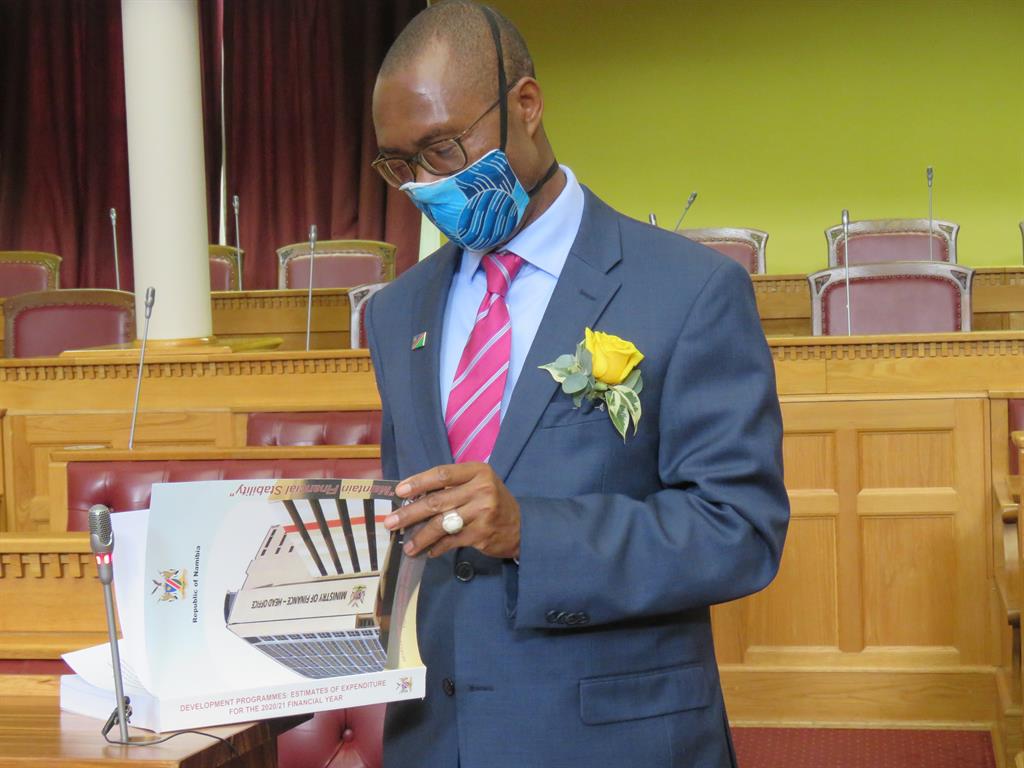

With a yellow rose adorning his suit pocket, Shiimi painted a bleak picture of the economic impacts of the coronavirus globally, continentally and regionally.“The sub-Saharan African region has also not escaped from the macroeconomic fallout of Covid-19. The sub-regional economy is projected to contract by 1.6%, from an expansion of 3.1% in 2019.”

Shiimi said closer to home, real GDP contraction for South Africa is now estimated at 5.8%, and the Angolan economy is projected to contract by 1.4%.

“Notably, these are the two largest neighbouring economies and key trading partners for Namibia.”

GDP to plunge by 6.6%

Amidst these developments, Namibia's economy is projected to contract by 6.6% in real terms this year.

“The contraction may as well linger on in 2021 at a moderate rate of 1.1%, with new normal average growth rates of between 2% and 3.6% in 2022 and beyond.

“Nominal GDP as a measure of final output for the 2019/20 fiscal year has been reduced by 10.9% or N$21.5 billion, relative to previous budget estimates. This reflects the combined effects of statistical adjustments in diamond exports and the Covid-19-induced effects during 2020,” Shiimi said.

For 2020/21, the implied reduction in nominal GDP relative to the MTEF indicative estimate stands at about N$34.7 billion, or some 16.9%.

“These shocks on final output have significant implications for fiscal targets, especially over the short-term. As such, the macroeconomic outlook of the fiscal strategy indicates that all elements of final demand, that is, net consumption and investment, are expected to decline during 2020,” the finance minister added.

He said exports are projected to decline by about 11.9% year-on-year in 2020, compared to the estimated decline of 1.1% a year ago, while imports are expected to decline by 14.9% in 2020, much faster than the fall in exports, reflecting the slowdown in investment and final consumption of goods and services.

The primary industry is projected to contract by 12.1%, reflecting demand-side induced shocks, especially for mining outputs.

Output in the secondary industry will contract by an estimated 2.6%, mainly as a result of deeper contractions in the construction subsector and manufacturing activity in the beverage and mineral beneficiation subsectors.

The decline in the tertiary industry is estimated at 5.7% for 2020, principally as a result of the direct effects of travel and social distancing restrictions on tourism, hotels and restaurants, transport and wholesale and retail trade subsectors.

Thriving again?

The budget was presented under the theme 'Together defeating COVID-19, together thriving again'.

Shiimi said this theme summons the collective contribution of all Namibians, young and old, to defeating the coronavirus outbreak as a necessary condition for future economic recovery and prosperity.

He said, among others, the budget is geared towards frontloading the emergency response budget to the health sector to enable it to procure and deploy the needed infrastructure, personal protective equipment, pharmaceuticals and personnel.

It had also mobilised a once-off Emergency Income Grant to save livelihoods and jobs.

The finance minister mentioned the N$750 grant targeted at low-income groups which was rolled out.

Shiimi said a total of 747 281 Namibians had so far benefited from the grant at a cost of N$561.96 million. A further 120 000 people are expected to benefit after the completion of the verification process.

Operational expenditure

The finance minister said non-interest operational expenditure is budgeted at N$57.9 billion, 8.8% more than the previous year, reflecting accelerated funding needed to fight the pandemic.

The development budget amounts to N$6.4 billion, 8.4% more than the actual development budget spending in the previous year.

“Given the weak revenue outlook, the budget deficit for 2020/21 is estimated at 12.5%of GDP. This is a once-off rise in the budget deficit, as we seek to adequately respond to the challenges posed by Covid-19 on the economy and social strata,” he said.

WINDHOEK

Finance minister Ipumbu Shiimi has tabled a N$64.3 billion budget, with a whopping extra N$8.4 billion, or 16.4% of revenue, earmarked for the payment of interest on government loans.

Therefore, total expenditure, including interest payments for the 2020/21 financial year, amounts to N$72.8 billion.

The medium-term expenditure framework (MTEF) released last year had estimated a N$60.4 billion budget this year, but that was before the coronavirus pandemic hit.

The budget deficit will be financed through a combination of savings and domestic and external borrowing.

“Taking into account the total financing requirements, the debt stock is estimated to rise to N$117.5 billion, corresponding to 68.7% of GDP, from 54.8% estimated for 2019/20.”

Shiimi described his 2020/21 offering as single-year budget, reflecting the commensurate urgency of addressing the elevated once-off needs arising from the impact of the pandemic.

With a yellow rose adorning his suit pocket, Shiimi painted a bleak picture of the economic impacts of the coronavirus globally, continentally and regionally.“The sub-Saharan African region has also not escaped from the macroeconomic fallout of Covid-19. The sub-regional economy is projected to contract by 1.6%, from an expansion of 3.1% in 2019.”

Shiimi said closer to home, real GDP contraction for South Africa is now estimated at 5.8%, and the Angolan economy is projected to contract by 1.4%.

“Notably, these are the two largest neighbouring economies and key trading partners for Namibia.”

GDP to plunge by 6.6%

Amidst these developments, Namibia's economy is projected to contract by 6.6% in real terms this year.

“The contraction may as well linger on in 2021 at a moderate rate of 1.1%, with new normal average growth rates of between 2% and 3.6% in 2022 and beyond.

“Nominal GDP as a measure of final output for the 2019/20 fiscal year has been reduced by 10.9% or N$21.5 billion, relative to previous budget estimates. This reflects the combined effects of statistical adjustments in diamond exports and the Covid-19-induced effects during 2020,” Shiimi said.

For 2020/21, the implied reduction in nominal GDP relative to the MTEF indicative estimate stands at about N$34.7 billion, or some 16.9%.

“These shocks on final output have significant implications for fiscal targets, especially over the short-term. As such, the macroeconomic outlook of the fiscal strategy indicates that all elements of final demand, that is, net consumption and investment, are expected to decline during 2020,” the finance minister added.

He said exports are projected to decline by about 11.9% year-on-year in 2020, compared to the estimated decline of 1.1% a year ago, while imports are expected to decline by 14.9% in 2020, much faster than the fall in exports, reflecting the slowdown in investment and final consumption of goods and services.

The primary industry is projected to contract by 12.1%, reflecting demand-side induced shocks, especially for mining outputs.

Output in the secondary industry will contract by an estimated 2.6%, mainly as a result of deeper contractions in the construction subsector and manufacturing activity in the beverage and mineral beneficiation subsectors.

The decline in the tertiary industry is estimated at 5.7% for 2020, principally as a result of the direct effects of travel and social distancing restrictions on tourism, hotels and restaurants, transport and wholesale and retail trade subsectors.

Thriving again?

The budget was presented under the theme 'Together defeating COVID-19, together thriving again'.

Shiimi said this theme summons the collective contribution of all Namibians, young and old, to defeating the coronavirus outbreak as a necessary condition for future economic recovery and prosperity.

He said, among others, the budget is geared towards frontloading the emergency response budget to the health sector to enable it to procure and deploy the needed infrastructure, personal protective equipment, pharmaceuticals and personnel.

It had also mobilised a once-off Emergency Income Grant to save livelihoods and jobs.

The finance minister mentioned the N$750 grant targeted at low-income groups which was rolled out.

Shiimi said a total of 747 281 Namibians had so far benefited from the grant at a cost of N$561.96 million. A further 120 000 people are expected to benefit after the completion of the verification process.

Operational expenditure

The finance minister said non-interest operational expenditure is budgeted at N$57.9 billion, 8.8% more than the previous year, reflecting accelerated funding needed to fight the pandemic.

The development budget amounts to N$6.4 billion, 8.4% more than the actual development budget spending in the previous year.

“Given the weak revenue outlook, the budget deficit for 2020/21 is estimated at 12.5%of GDP. This is a once-off rise in the budget deficit, as we seek to adequately respond to the challenges posed by Covid-19 on the economy and social strata,” he said.

Comments

Namibian Sun

No comments have been left on this article