COMPANY NEWS IN BRIEF

Sasol gives up licence

South African petrochemicals giant Sasol Ltd has opted to give up its licence to explore for gas off the Mozambique coast, the company said.

"Sasol will return Block 16/19 in its entirety to the government of Mozambique. To this end, a withdrawal notification has already been sent to the relevant Mozambican authorities", the firm said in a statement.

Sasol was awarded the research licence in 2005. In 2013 it abandoned the deep-water part of the licence, retaining the shallow water allotment to assess its hydrocarbon potential. It is still exploring for gas onshore in the fields of Pande and Temane, in the northern province of Inhambane.

Sasol, the world's top producer of motor fuel from coal, is trying to shed assets to pay off its debt pile and avoid a rights issue of up to US$2 billion. - Nampa/Reuters

Uber agrees on US$2.65 bln deal

Ride-sharing company Uber Technologies Inc has agreed on a deal to buy food-delivery app Postmates Inc in a US$2.65 billion all-stock agreement, Bloomberg News reported, citing people familiar with the matter.

The deal has been approved by Uber's board and could be announced as soon as Monday, Bloomberg reported, adding that Pierre-Dimitri Gore-Coty, head of Uber's food delivery business, Uber Eats, is expected to continue to run the combined delivery business.

Uber and Postmates did not immediately respond to a Reuters request for comment. Last week, Reuters reported that Postmates had revived plans for an initial public offering following deal making in the US online food delivery service sector that sparked acquisition interest in the company.

Postmates was last valued at US$2.4 billion, when it raised US$225 million in a private fundraising round last September.

Uber had plans to also acquire Grubhub Inc through its Uber Eats business, but walked away from the deal as Just Eat Takeaway.com NV eventually reached a US$7.3 billion agreement last month to buy the US online food delivery company. – Nampa/Reuters

SoftBank governance reforms

SoftBank Group Corp has no plans to increase board oversight of its US$100 billion Vision Fund, two sources said, disregarding calls from activist investor Elliott Management and signalling governance reforms have stopped short of the fund.

In recent months chief executive Masayoshi Son has met other Elliott demands, from launching a 2.5 trillion-yen (US$23 billion) buyback vital to propping up SoftBank's share prices to increasing the number of outside directors including the board's only woman.

However even after a disastrous run betting on start-ups like office-sharing firm WeWork that plunged the Japanese conglomerate to its biggest-ever annual loss, power structures at the Vision Fund remain largely intact.

SoftBank has pushed back against creating such a committee, with executives arguing investments already vetted by top management and US$3-5 billion deals put to the large limited partners, said one of the people with direct knowledge of the matter, who declined to be identified as the matter was private.

The fund's poor performance scuppered plans to raise a further mega fund from investors including the first fund's anchor backers, the sovereign wealth funds of Saudi Arabia and Abu Dhabi. – Nampa/Reuters

Samsung's chips sales falls

At Samsung Electronics Co Ltd, demand for its chips from data centers bulking up to meet a surge in work-from-home traffic was not likely enough to offset muted sales of its smartphones in the second quarter, analysts said.

The world's biggest supplier of DRAM and NAND memory chips on Tuesday will announce preliminary April-June revenue as well as operating profit, which it previously expected to show a decline.

Profit likely fell 4.5% to 6.3 trillion won (US$5.25 billion) from the same period year earlier, according to Refinitiv Smart Estimate, which is weighted towards the more consistently accurate analysts.

Work-from-home orders and growth in online learning is underpinning chip demand amid the Covid-19 pandemic, prompting US DRAM supplier Micron Technology Inc to forecast strong quarterly revenue last month.

Chips bring in roughly half of Samsung's profit. The rest is mainly smartphones, of which the South Korean firm is the world's largest maker.

"With improved demand, a spike in DRAM prices helped Samsung continue with a solid performance in the second quarter," said analyst Park Sung-soon at Cape Investment & Securities. – Nampa/Reuters

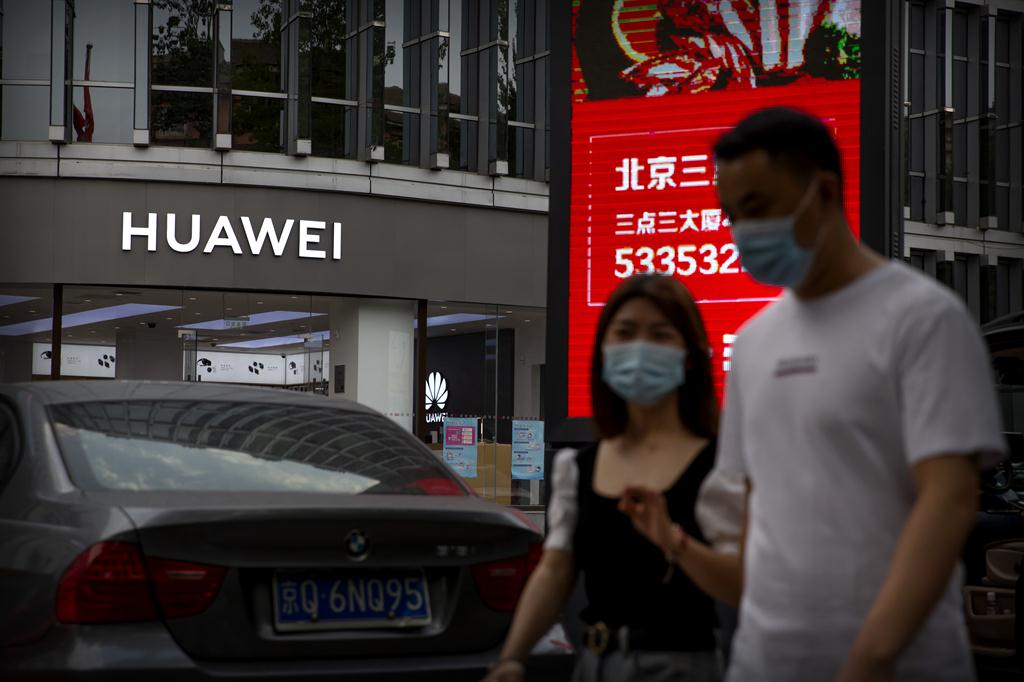

France won't ban Huawei

The head of the French cybersecurity agency ANSSI said there would not be a total ban on using equipment from Huawei in the rollout of the French 5G telecoms network, but that it was pushing French Telco’s to avoid switching to the Chinese company.

"What I can say is that there won't be a total ban," Guillaume Poupard told Les Echos newspaper in an interview. "But for operators that are not currently using Huawei, we are inciting them not to go for it."

The US government has urged its allies to exclude the Chinese telecoms giant from the West's next-generation communications, saying Beijing could use it for spying. Huawei has denied the charges.

Sources told Reuters in March France would not ban Huawei but would seek to keep it out of the core mobile network, which carries higher surveillance risks because it processes sensitive information such as customers' personal data.

France's decision over Huawei's equipment is crucial for two of the country's four telecoms operators, Bouygues Telecom and SFR, as about half of their current mobile network is made by the Chinese group. – Nampa/Reuters

South African petrochemicals giant Sasol Ltd has opted to give up its licence to explore for gas off the Mozambique coast, the company said.

"Sasol will return Block 16/19 in its entirety to the government of Mozambique. To this end, a withdrawal notification has already been sent to the relevant Mozambican authorities", the firm said in a statement.

Sasol was awarded the research licence in 2005. In 2013 it abandoned the deep-water part of the licence, retaining the shallow water allotment to assess its hydrocarbon potential. It is still exploring for gas onshore in the fields of Pande and Temane, in the northern province of Inhambane.

Sasol, the world's top producer of motor fuel from coal, is trying to shed assets to pay off its debt pile and avoid a rights issue of up to US$2 billion. - Nampa/Reuters

Uber agrees on US$2.65 bln deal

Ride-sharing company Uber Technologies Inc has agreed on a deal to buy food-delivery app Postmates Inc in a US$2.65 billion all-stock agreement, Bloomberg News reported, citing people familiar with the matter.

The deal has been approved by Uber's board and could be announced as soon as Monday, Bloomberg reported, adding that Pierre-Dimitri Gore-Coty, head of Uber's food delivery business, Uber Eats, is expected to continue to run the combined delivery business.

Uber and Postmates did not immediately respond to a Reuters request for comment. Last week, Reuters reported that Postmates had revived plans for an initial public offering following deal making in the US online food delivery service sector that sparked acquisition interest in the company.

Postmates was last valued at US$2.4 billion, when it raised US$225 million in a private fundraising round last September.

Uber had plans to also acquire Grubhub Inc through its Uber Eats business, but walked away from the deal as Just Eat Takeaway.com NV eventually reached a US$7.3 billion agreement last month to buy the US online food delivery company. – Nampa/Reuters

SoftBank governance reforms

SoftBank Group Corp has no plans to increase board oversight of its US$100 billion Vision Fund, two sources said, disregarding calls from activist investor Elliott Management and signalling governance reforms have stopped short of the fund.

In recent months chief executive Masayoshi Son has met other Elliott demands, from launching a 2.5 trillion-yen (US$23 billion) buyback vital to propping up SoftBank's share prices to increasing the number of outside directors including the board's only woman.

However even after a disastrous run betting on start-ups like office-sharing firm WeWork that plunged the Japanese conglomerate to its biggest-ever annual loss, power structures at the Vision Fund remain largely intact.

SoftBank has pushed back against creating such a committee, with executives arguing investments already vetted by top management and US$3-5 billion deals put to the large limited partners, said one of the people with direct knowledge of the matter, who declined to be identified as the matter was private.

The fund's poor performance scuppered plans to raise a further mega fund from investors including the first fund's anchor backers, the sovereign wealth funds of Saudi Arabia and Abu Dhabi. – Nampa/Reuters

Samsung's chips sales falls

At Samsung Electronics Co Ltd, demand for its chips from data centers bulking up to meet a surge in work-from-home traffic was not likely enough to offset muted sales of its smartphones in the second quarter, analysts said.

The world's biggest supplier of DRAM and NAND memory chips on Tuesday will announce preliminary April-June revenue as well as operating profit, which it previously expected to show a decline.

Profit likely fell 4.5% to 6.3 trillion won (US$5.25 billion) from the same period year earlier, according to Refinitiv Smart Estimate, which is weighted towards the more consistently accurate analysts.

Work-from-home orders and growth in online learning is underpinning chip demand amid the Covid-19 pandemic, prompting US DRAM supplier Micron Technology Inc to forecast strong quarterly revenue last month.

Chips bring in roughly half of Samsung's profit. The rest is mainly smartphones, of which the South Korean firm is the world's largest maker.

"With improved demand, a spike in DRAM prices helped Samsung continue with a solid performance in the second quarter," said analyst Park Sung-soon at Cape Investment & Securities. – Nampa/Reuters

France won't ban Huawei

The head of the French cybersecurity agency ANSSI said there would not be a total ban on using equipment from Huawei in the rollout of the French 5G telecoms network, but that it was pushing French Telco’s to avoid switching to the Chinese company.

"What I can say is that there won't be a total ban," Guillaume Poupard told Les Echos newspaper in an interview. "But for operators that are not currently using Huawei, we are inciting them not to go for it."

The US government has urged its allies to exclude the Chinese telecoms giant from the West's next-generation communications, saying Beijing could use it for spying. Huawei has denied the charges.

Sources told Reuters in March France would not ban Huawei but would seek to keep it out of the core mobile network, which carries higher surveillance risks because it processes sensitive information such as customers' personal data.

France's decision over Huawei's equipment is crucial for two of the country's four telecoms operators, Bouygues Telecom and SFR, as about half of their current mobile network is made by the Chinese group. – Nampa/Reuters

Comments

Namibian Sun

No comments have been left on this article