A rock-hard year for Namdeb

A slump in production, lower realised prices and high unit costs hammered Namdeb Holdings’ profitability last year.

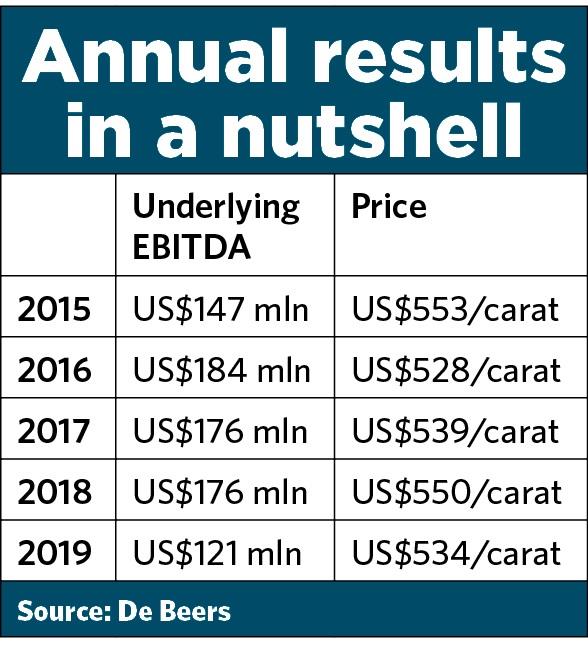

Jo-Maré Duddy – Namdeb Holdings’ profitability tumbled by nearly a third last year with the local mining giant reporting an underlying EBITDA of US$121 million for the year ended 31 December 2019.

This is US$55 million less than the previous financial year, according to results released by De Beers yesterday. De Beers owns 50% of Namdeb Holdings, with the rest in the hands of the Namibian government.

EBITDA stands for earnings before interest, taxes, depreciation and amortisation and is regarded as a gauge for a company’s profitability. At yesterday’s exchange rate, Namdeb Holdings showed an EBITDA of nearly N$1.8 billion in 2019.

The company’s production dropped from 2.008 million carats in 2018 to 1.7 million carats in the past book-year.

De Beers attributed the 15%-drop in production to marine output falling by 10% due to the planned maintenance for the Mafuta vessel.

“Production at the land operations decreased by 29% to 0.4 million carats (2018: 0.6 million carats) as a result of placing Elizabeth Bay onto care and maintenance in December 2018. In September 2019, the sale of Elizabeth Bay was announced,” De Beers said.

Local analysts at Cirrus Securities regard the sale of the Elizabeth Bay to Lewcor as an “exciting development”. It “sees a new operator in the space for the first time in many years”, Cirrus says in their economic outlook for 2020.

Crown jewels

Namdeb also had to cope with a lower realised price last year. The average realised price of US$534 per carat – more than N$8 000 per carat – is nearly 3% less than in 2018.

Despite the drop, Namdeb’s gems still by far fetched the highest realised price of all the subsidiaries in the De Beers group. Botswana’s diamonds on average fetched US$139 per carat, followed by US$119 by diamonds mined in Canada and US$108 for those produced in South Africa.

However, Namdeb’s unit costs were drastically higher than those of the other countries. For the past financial year, Namdeb mined at a unit cost of US$303 per compared to US$73 (South Africa), US$44 (Canada) and US$29 (Botswana).

Namdeb’s capital expenditure for 2019 was US$55 million, nearly N$830 million.

In total, De Beers produced some 30.8 million carats of diamonds in 2019 compared to nearly 35.3 million in 2018. The group reported an underlying EBITDA of US$558 million, slumping by 55% year-on-year.

Challenges

De Beers said a range of factors created significant challenges for rough diamond demand last year.

“In late 2018, stock market volatility and US-China trade tensions resulted in lower than expected holiday retail sales, which led to higher than anticipated stock levels in the industry’s midstream at the start of 2019.

“Throughout the course of 2019, the midstream inventory position was under further pressure due to the closure of some US 'bricks and mortar' retail outlets, an increase in online purchasing (where inventory levels are lower), and retailers increasing their stock held on consignment. Tighter financing also affected the mid-stream’s ability to hold stock, all of which resulted in lower demand for rough diamonds,” De Beers said.

In US dollar terms, global consumer demand for diamond jewellery was broadly flat in 2019, the group said.

“US consumer demand remained reasonably strong, but growth in local currency terms in China and Japan was offset by the strength of the US dollar, while demand from India and the Gulf declined,” De Beers said.

Corona

Preliminary data following the holiday retail season in 2019 indicates that stock levels in the industry’s midstream are returning to a more balanced position following stable consumer demand, especially in the US, De Beers said.

“However, risks remain to the downside, with further increases in online purchasing causing additional retailer destocking, developments in US-China trade tensions, the coronavirus which originated in China over Chinese New Year, geo-political escalation in the Middle East and the effect those may have on economic growth and consumer sentiment,” the group explained.

The Africa-focussed miner, Petra Diamonds, on Monday said the coronavirus outbreak had dented demand in the diamond market as stores were forced to close during the important Lunar New Year holiday period in China.

The coronavirus is a new threat to the diamond industry, which has already been hit by lower demand from China, the world's second largest market after the United States, following a prolonged trade war and pro-democracy protests in Hong Kong, Reuters said.

China has seen retail stores shut and the Hong Kong and diamond auctions and industry events had been delayed or relocated.

Commenting on the possible impact of the coronavirus on Namibia, the governor of the Bank of Namibia (BoN) on Wednesday said if the Chinese economy slows down, it might hurt Namdeb’s diamond sales. The situation might worsen if the virus hits the US, he said.

In their economic outlook, Cirrus says major growth in diamond output is only expected from 2022, with the completion and introduction of Debmarine Namibia’s N$7-billion vessel.

“Namdeb’s onshore operations are expected to be shut down over the next few years, where most of its employment lies. However, this could be delayed as Namdeb is seeking reprieve in the form of changes to royalty payments, which would see the land-based mining continue,” Cirrus said.

[email protected]

This is US$55 million less than the previous financial year, according to results released by De Beers yesterday. De Beers owns 50% of Namdeb Holdings, with the rest in the hands of the Namibian government.

EBITDA stands for earnings before interest, taxes, depreciation and amortisation and is regarded as a gauge for a company’s profitability. At yesterday’s exchange rate, Namdeb Holdings showed an EBITDA of nearly N$1.8 billion in 2019.

The company’s production dropped from 2.008 million carats in 2018 to 1.7 million carats in the past book-year.

De Beers attributed the 15%-drop in production to marine output falling by 10% due to the planned maintenance for the Mafuta vessel.

“Production at the land operations decreased by 29% to 0.4 million carats (2018: 0.6 million carats) as a result of placing Elizabeth Bay onto care and maintenance in December 2018. In September 2019, the sale of Elizabeth Bay was announced,” De Beers said.

Local analysts at Cirrus Securities regard the sale of the Elizabeth Bay to Lewcor as an “exciting development”. It “sees a new operator in the space for the first time in many years”, Cirrus says in their economic outlook for 2020.

Crown jewels

Namdeb also had to cope with a lower realised price last year. The average realised price of US$534 per carat – more than N$8 000 per carat – is nearly 3% less than in 2018.

Despite the drop, Namdeb’s gems still by far fetched the highest realised price of all the subsidiaries in the De Beers group. Botswana’s diamonds on average fetched US$139 per carat, followed by US$119 by diamonds mined in Canada and US$108 for those produced in South Africa.

However, Namdeb’s unit costs were drastically higher than those of the other countries. For the past financial year, Namdeb mined at a unit cost of US$303 per compared to US$73 (South Africa), US$44 (Canada) and US$29 (Botswana).

Namdeb’s capital expenditure for 2019 was US$55 million, nearly N$830 million.

In total, De Beers produced some 30.8 million carats of diamonds in 2019 compared to nearly 35.3 million in 2018. The group reported an underlying EBITDA of US$558 million, slumping by 55% year-on-year.

Challenges

De Beers said a range of factors created significant challenges for rough diamond demand last year.

“In late 2018, stock market volatility and US-China trade tensions resulted in lower than expected holiday retail sales, which led to higher than anticipated stock levels in the industry’s midstream at the start of 2019.

“Throughout the course of 2019, the midstream inventory position was under further pressure due to the closure of some US 'bricks and mortar' retail outlets, an increase in online purchasing (where inventory levels are lower), and retailers increasing their stock held on consignment. Tighter financing also affected the mid-stream’s ability to hold stock, all of which resulted in lower demand for rough diamonds,” De Beers said.

In US dollar terms, global consumer demand for diamond jewellery was broadly flat in 2019, the group said.

“US consumer demand remained reasonably strong, but growth in local currency terms in China and Japan was offset by the strength of the US dollar, while demand from India and the Gulf declined,” De Beers said.

Corona

Preliminary data following the holiday retail season in 2019 indicates that stock levels in the industry’s midstream are returning to a more balanced position following stable consumer demand, especially in the US, De Beers said.

“However, risks remain to the downside, with further increases in online purchasing causing additional retailer destocking, developments in US-China trade tensions, the coronavirus which originated in China over Chinese New Year, geo-political escalation in the Middle East and the effect those may have on economic growth and consumer sentiment,” the group explained.

The Africa-focussed miner, Petra Diamonds, on Monday said the coronavirus outbreak had dented demand in the diamond market as stores were forced to close during the important Lunar New Year holiday period in China.

The coronavirus is a new threat to the diamond industry, which has already been hit by lower demand from China, the world's second largest market after the United States, following a prolonged trade war and pro-democracy protests in Hong Kong, Reuters said.

China has seen retail stores shut and the Hong Kong and diamond auctions and industry events had been delayed or relocated.

Commenting on the possible impact of the coronavirus on Namibia, the governor of the Bank of Namibia (BoN) on Wednesday said if the Chinese economy slows down, it might hurt Namdeb’s diamond sales. The situation might worsen if the virus hits the US, he said.

In their economic outlook, Cirrus says major growth in diamond output is only expected from 2022, with the completion and introduction of Debmarine Namibia’s N$7-billion vessel.

“Namdeb’s onshore operations are expected to be shut down over the next few years, where most of its employment lies. However, this could be delayed as Namdeb is seeking reprieve in the form of changes to royalty payments, which would see the land-based mining continue,” Cirrus said.

[email protected]

Comments

Namibian Sun

No comments have been left on this article